Economic Insights

This collection of the latest updates and data from the systems integration industry explores leading indicators including the CEO Confidence Index, Purchasing Managers Index, and CSIA updates. We offer our own insights based on the information referenced and interactions with Exotek clients and the SI community.

CEO Confidence Index and PMI

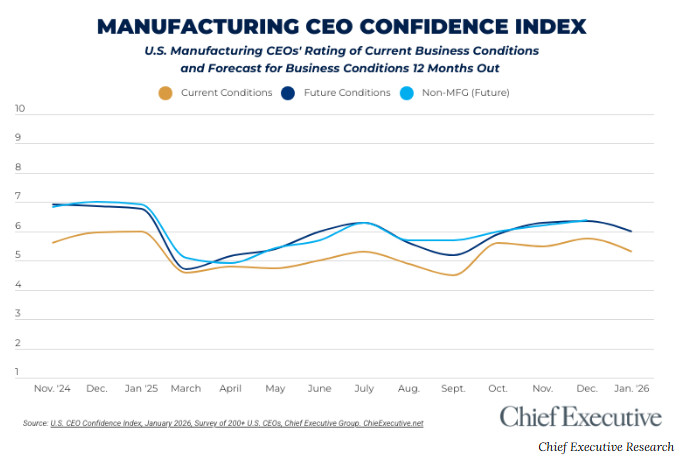

Manufacturing CEO Confidence Falls at Year Start

After ending 2025 on an upswing, manufacturing CEOs entered 2026 with lower confidence, driven primarily by tariff uncertainty, cost pressures, and policy unpredictability. Despite the decline in sentiment, expectations for growth, revenue, and investment remain broadly positive.

- Manufacturing CEOs rate future business conditions at 6.0 / 10, down from 6.3 in December but still roughly in line with most of 2025.

- 77% expect to increase revenues in the year ahead, essentially unchanged from the prior month.

- 68% expect profits to increase, still elevated despite a modest decline from December.

- 43% expect to increase capital investment, unchanged month to month.

- 48% expect to add headcount, recovering from the prior month’s dip.

- 61% of manufacturing CEOs expect economic growth in the next six months, while only 11% expect a recession.

Confidence dipped, but operating expectations remain constructive — a signal of caution, not contraction.

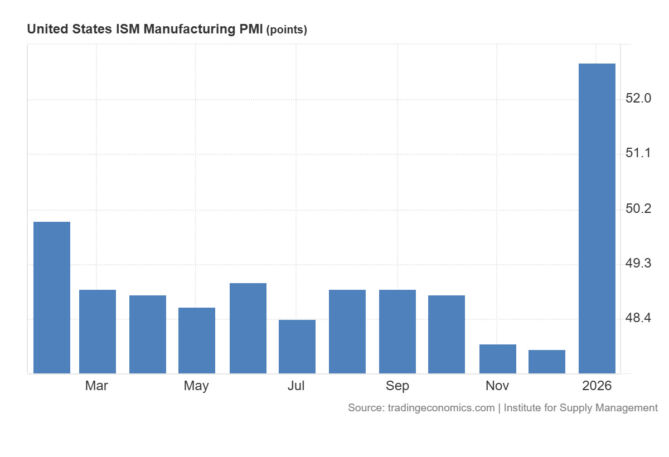

Manufacturing Returns to Expansion, Services Hold Steady

U.S. supply managers report mixed but broadly constructive activity at the start of 2026. After more than a year of contraction, the manufacturing sector moved back into expansion territory in January, while services activity remained solidly in growth mode — suggesting continued broad economic momentum even as some sector-specific pressures persist.

Manufacturing PMI – January 2026

- The manufacturing PMI registered 52.6%, up from 47.9% in December and marking the first expansion in 12 months.

- New orders strengthened sharply, reflecting restocking and order growth after holiday lulls.

- Production climbed to its highest levels in years, though employment remained in contraction.

Services PMI – January 2026

- The services PMI registered 53.8%, maintaining expansion for the 19th consecutive month and signaling sustained activity in the dominant sector of the economy.

- Service sector growth remains moderate, with new orders and activity supporting ongoing expansion.

OUR KEY TAKEAWAYS

Caution is rising, but operating fundamentals remain sound.

Manufacturing CEO confidence declined at the start of the year, driven primarily by policy uncertainty and cost pressures rather than weakening demand. At the same time, most manufacturers still expect revenue growth, profitability improvement, and continued investment. PMI data reinforces this distinction: manufacturing has returned to expansion and services remain solid. The signal is increased caution in decision-making, not a pullback in activity.

Investment remains selective — scrutiny is high.

Despite softer sentiment, a majority of manufacturers continue to plan revenue growth and capital spending. PMI sub-indices suggest companies are moving forward carefully, favoring phased projects and clearly defined scopes over broad, enterprise-wide initiatives.

Productivity and reliability projects stay at the front of the line.

With manufacturing employment still constrained, manufacturers remain focused on maximizing existing assets. Projects tied to reliability, throughput improvement, labor substitution, and modernization with clear payback continue to outrank capacity-expansion efforts.

Planning is accelerating ahead of execution.

Improving PMI activity and still-strong revenue expectations point to more planning, budgeting, and feasibility discussions for 2026, even as authorization lags. Integrators that engage early to shape scope, timing, and ROI will be best positioned as intent converts to funded work.

Expect a gradual, uneven expansion — not a clean inflection.

Taken together, manufacturing sentiment and activity indicators point to a slow, uneven strengthening through 2026 rather than a sharp early year rebound. Confidence remains constructive, but behavior is measured. Disciplined execution and close client engagement will determine who captures early momentum.

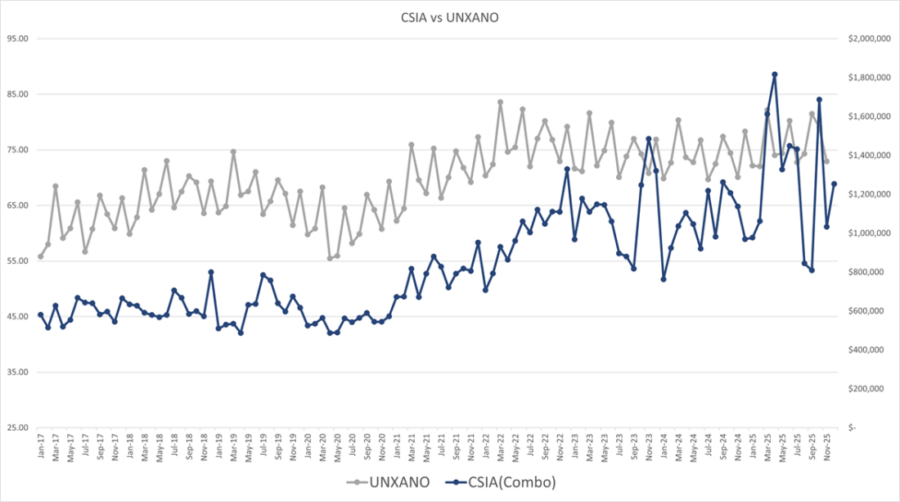

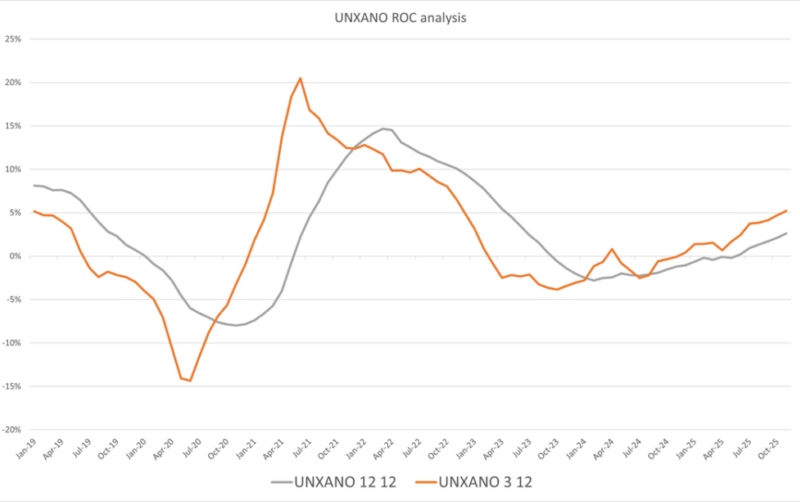

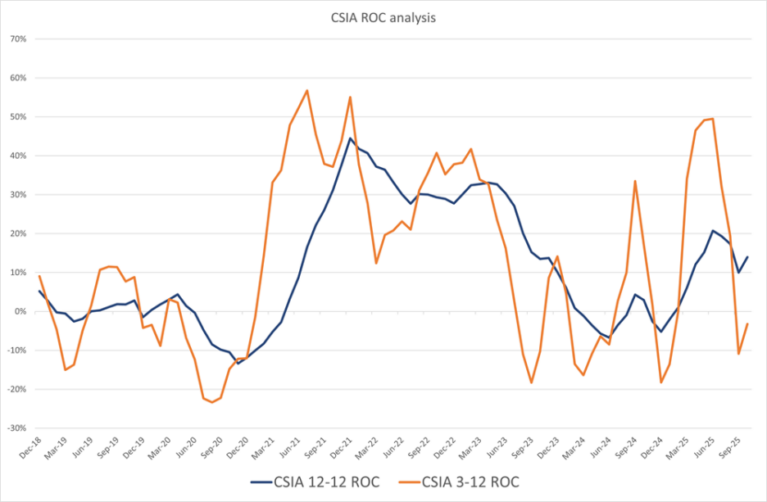

Non-Defense Capital Goods Excluding Aircraft (UNXANO) ROC Analysis

We have transitioned from tracking US Capital Goods New Orders (USCGNO) to UNXANO which provides a clearer indication of actual capital spending and better aligns with the focus of most system integrators.

OUR KEY TAKEAWAYS

The UNXANO index has firmly entered growth territory, although just above the contraction line, signaling improvements in capital spending and automation demand.

- Capital Spending Recovery: Both 3/12 and 12/12 rates of change remained positive in 2025, reflecting renewed momentum in new orders.

- Short-Term Strength: Short-term growth (3/12) is outpacing the longer-term trend (12/12), which suggests a bullish outlook.

- Implications for SIs: Rising capital spending is driving more automation projects, despite ongoing price competition. End users still pursue multiple bids and push for lower prices, but demand will increase when capacity becomes urgent and price sensitivity lessens.

The CSIA ROC implies the SI industry would benefit from more capital goods orders in automation-related spending. With upward pressure from the 3/12, current indications suggest a steady progression throughout 2026.

In summary, system integrators can anticipate slow, but positive movement as market conditions improve. We will continue to monitor developments.

CSIA STATS ANALYSIS

OUR KEY TAKEAWAYS

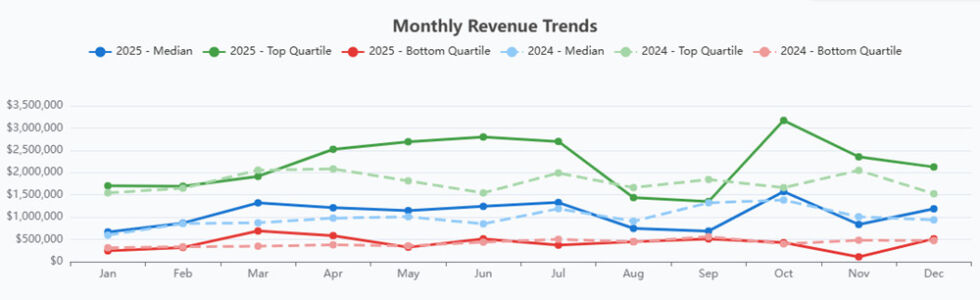

Revenue closed 2025 stronger than it began.

December revenue rebounded across the bottom, median, and top revenue quartiles to at or above December 2024 levels, likely reflecting year-end project close-outs and revenue recognition rather than a broad acceleration in demand.

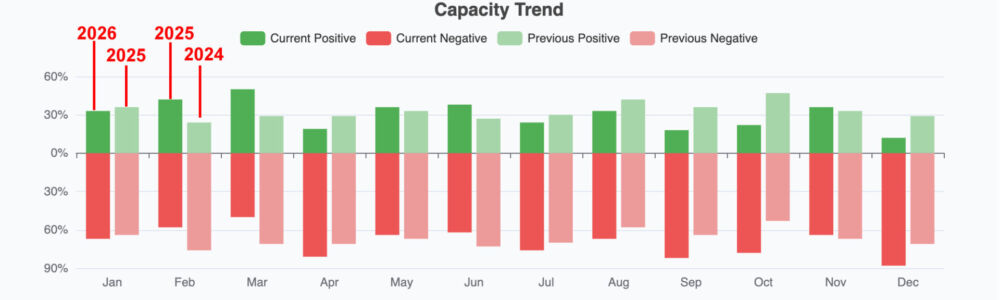

Utilization remains uneven across the SI community, reflecting capacity imbalance rather than labor shortage.

In the latest CSIA snapshot, 33% of firms report having no capacity (fully loaded) while 67% report having capacity available. This indicates the community is not uniformly constrained — rather, many firms are still working to maintain consistent utilization. The challenge is less about staffing and more about uneven project timing, delayed customer approvals, and lumpy project flow.

Outlook remains strongly positive.

Approximately 90% of firms report a positive outlook, indicating continued confidence in future demand even as utilization and project timing remain uneven.

Net signal: uneven demand and execution timing.

SIs are seeing opportunity, but not always at the right pace or mix to keep teams fully utilized. The focus for many firms remains smoothing backlog, tightening project selection, and improving conversion from planning to execution.