Economic Insights

This collection of the latest updates and data from the systems integration industry explores leading indicators including the CEO Confidence Index, Purchasing Managers Index, and CSIA updates. We offer our own insights based on the information referenced and interactions with Exotek clients and the SI community.

CEO Confidence Index and PMI

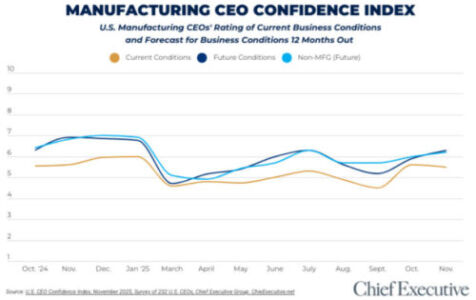

Manufacturing CEO Confidence Rises Again as Optimism Builds for 2026

Manufacturing CEOs extended last month’s rebound, reflecting a slow but steady shift toward optimism heading into the new year. While macro indicators remain mixed, executives report improving visibility, stabilizing demand, and growing readiness to invest.

- CEOs now rate future business conditions at 6.3 / 10, marking another month of upward momentum.

- 67% expect revenues to grow in the next 12 months (+8 pts).

- 59% expect profits to increase (+11 pts).

- 46% plan to increase capital expenditures next year (+14 pts).

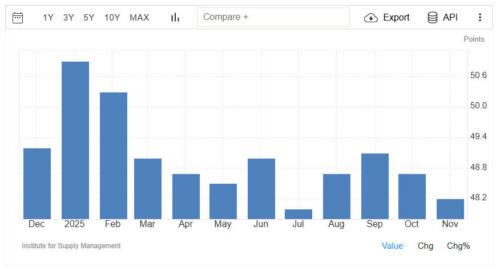

Manufacturing Sector Economic Activity Contracts for the Ninth Consecutive Month

The Manufacturing PMI registered 48.2 in November, down from 48.7 in October, signaling continued contraction in overall activity. This marks the ninth straight month below the expansion threshold, reinforcing a picture of soft but persistent weakness across the sector.

Key Index Readings (November):

- New Orders: Contracting (47.4, –2.0)

- Production: Expanding (51.4, +3.2) — the lone index showing growth

- Employment: Contracting (44.0, –2.0)

- Supplier Deliveries: Slowing (53.6, –0.6)

- Inventories: Contracting (45.3, –0.5)

- Customers’ Inventories: Too low (44.7, –2.4)

- Prices: Increasing (58.5, +0.5)

- Exports and Imports: Both contracting

OUR KEY TAKEAWAYS

Manufacturing Outlook: Optimism Rises Even as Activity Remains Soft

CEO and PMI Indices

November’s data presents a seemingly contradictory picture: CEO sentiment is improving sharply, while PMI activity metrics show another month of contraction. Taken together, these indicators point to a sector that believes conditions will strengthen in 2026 — even as near-term demand remains uneven and cost pressures persist.

CEO confidence continues to climb. – Manufacturing leaders report rising expectations across revenue, profit, hiring, and capital investment for the year ahead. Many cite stronger visibility into 2026 demand, healthier backlogs, and a belief that interest rate and supply-chain stability will support gradual recovery.

But the PMI shows the present is still challenging. – The November PMI came in at 48.2, marking the ninth consecutive month of contraction. Demand indicators — New Orders, Backlog, Employment — remain weak. Manufacturers are still cautious about committing to large projects, expanding headcount, or increasing capacity.

Why the disconnect? Manufacturers are looking past current softness.

Three dynamics help explain why leaders feel more optimistic than the activity data suggests:

- Backlogs remain serviceable — even if new orders are slow. CEOs are confident because they can see a path through 2026 with existing demand. PMI measures current activity, while CEO surveys reflect future expectations.

- Stabilizing conditions feel better than the volatility of earlier months. Even with contraction, the rate of decline is shallow and predictable. Manufacturers view this as the bottoming-out phase, not ongoing erosion.

- Investment planning cycles are long. Many leaders are preparing for 2026 initiatives now, even if they don’t expect visible activity to turn until mid-year. That generates optimism before it shows up in the data.

What This Means for System Integrators

- Expect selective investment — not a broad surge. Even optimistic CEOs are still navigating real-time softness. SIs should anticipate incremental, tightly scoped projects rather than sweeping expansions.

- Position around productivity, not capacity. With New Orders and Employment contracting, manufacturers are focused on efficiency improvement, margin protection, and labor substitution. Deliverables that “pay for themselves” will land first.

- Domestic markets will turn sooner. CEO optimism is notably higher among U.S.-only manufacturers. Integrators serving domestic-heavy portfolios may feel the rebound earlier.

- Hiring and skill shortages remain an advantage for integrators. With employment contracting, manufacturers continue to rely on external engineering capacity — strengthening demand for outsourced automation services and managed support models.

- Prepare now for a gradual mid-2026 recovery. CEO sentiment typically leads hard data by 3–6 months. If optimism continues rising into Q1, activity levels should follow during the second half of 2026. Integrators who stay close to clients, refine offerings, and focus on execution excellence are best positioned.

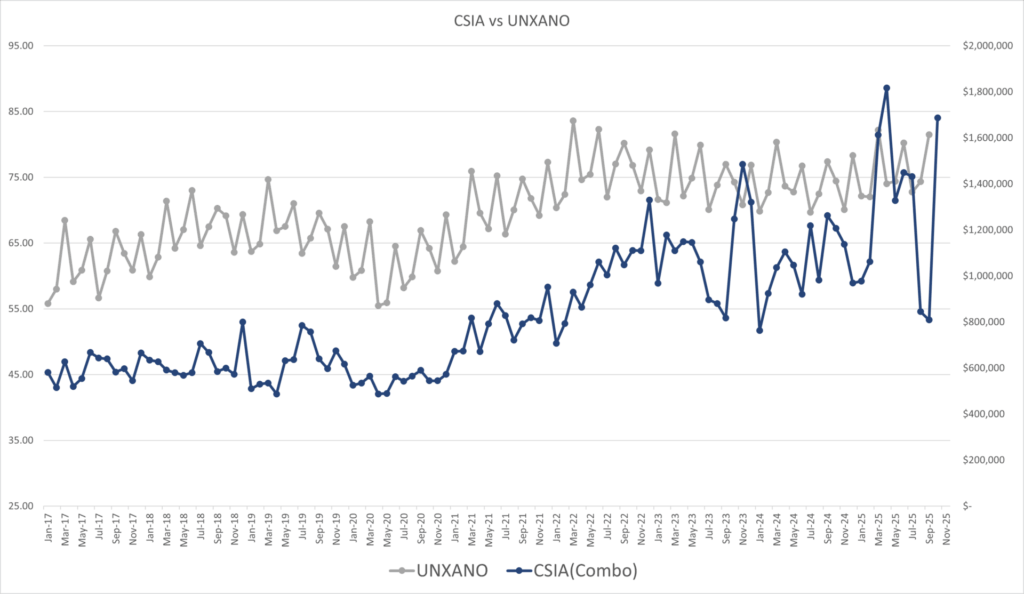

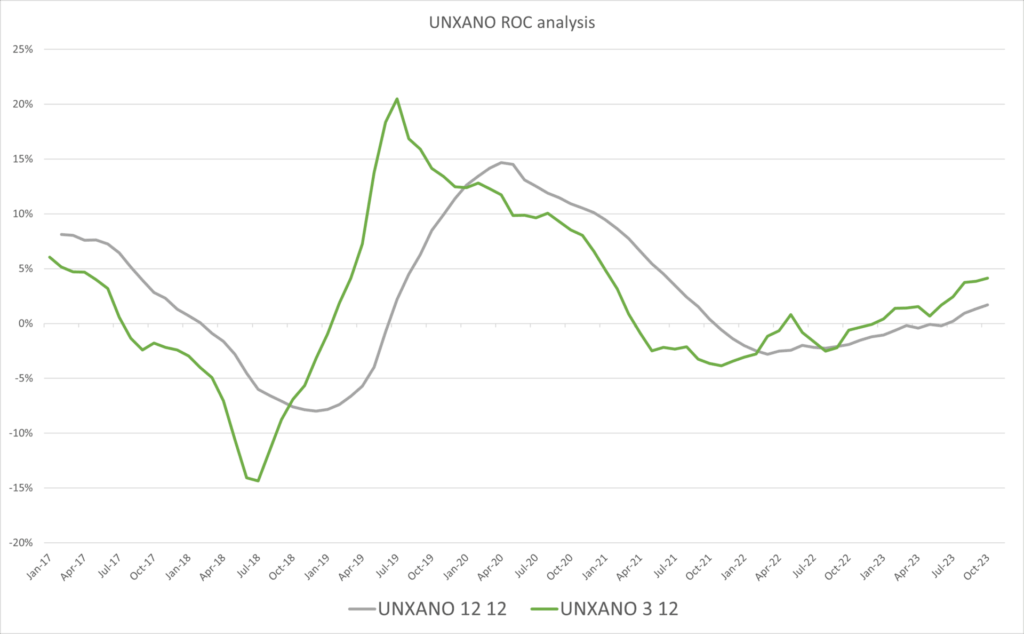

Non-Defense Capital Goods Excluding Aircraft (UNXANO) ROC Analysis

We have transitioned from tracking US Capital Goods New Orders (USCGNO) to UNXANO which provides a clearer indication of actual capital spending and better aligns with the focus of most system integrators.

OUR KEY TAKEAWAYS

The UNXANO index is showing early signs of returning to growth territory—a positive signal for capital spending and automation demand.

- Capital Spending Recovery: Both the 3/12 and 12/12 rates of change have moved into positive territory, indicating renewed momentum in new orders.

- Short-term Strength: The 3/12 line remains above the 12/12 line, suggesting near-term growth is outpacing the longer-term trend—a bullish indicator.

- Implications for SIs: As capital spending expands, automation projects are likely to follow. For now, end users continue to seek multiple bids and apply price pressure. Watch for a shift when urgency to secure capacity outweighs price sensitivity—this will mark a stronger demand cycle.

Together, these signals point to a cautiously optimistic outlook for system integrators as the market transitions toward growth.

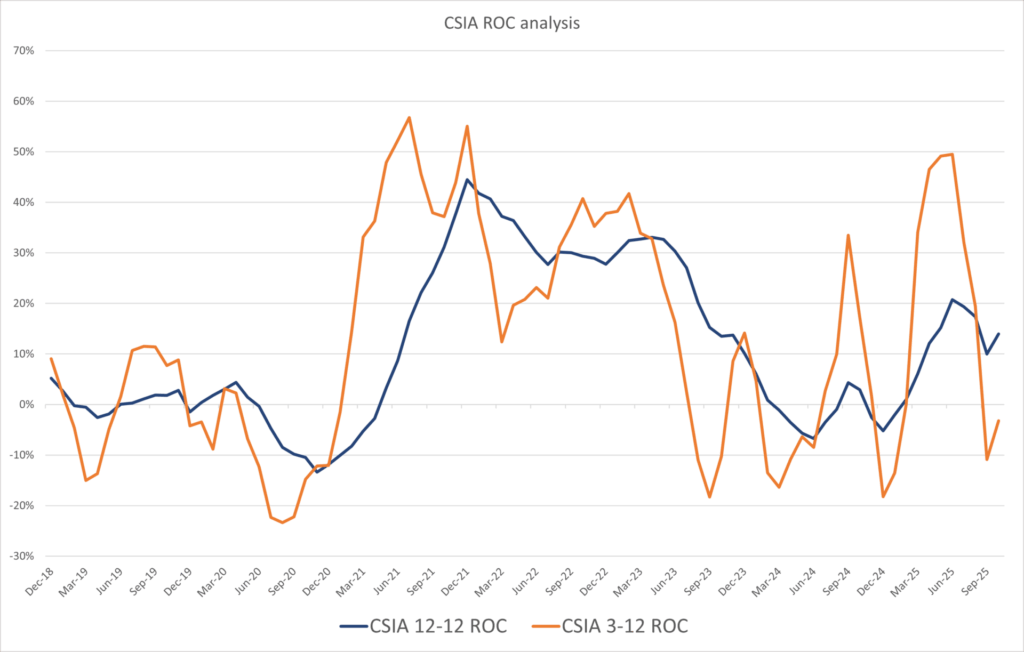

The CSIA ROC indicates that the industry would benefit from more capital goods orders flowing into automation-related spending. The 3/12 is clearly exerting downward pressure on the 12/12, with no signs of improvement evident. We will continue to monitor closely, as things could shift rapidly.

CSIA STATS ANALYSIS

OUR KEY TAKEAWAYS

Early Signs of Strength Returning Across Our SI Community

The latest CSIA EZ Statistics results show meaningful improvement across several indicators. Revenues strengthened—particularly among top-performing firms—capacity tightened significantly (+12), and optimism soared (+27) heading into year-end. While conditions are not uniformly strong, the data suggests that the SI community is beginning to see the early stages of a demand recovery.

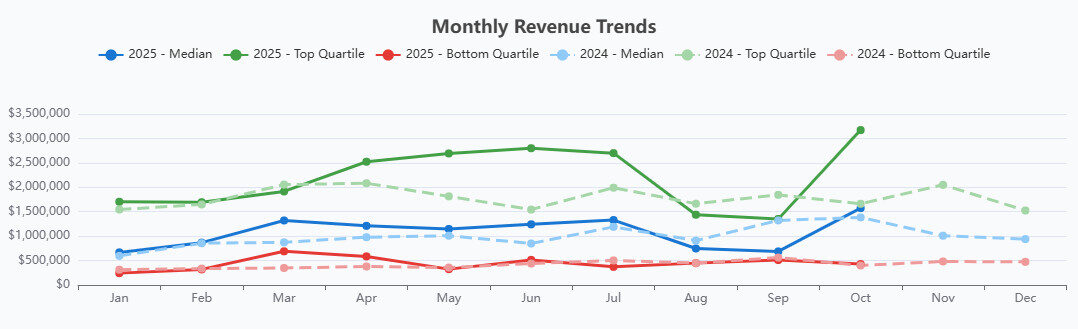

- Revenue: Broad stabilization with strong top-quartile acceleration. Median revenue rose to $1.57M, comfortably ahead of last year, while top-quartile firms jumped above $3.1M, one of the largest single-month increases observed this year. Bottom-quartile performance remains flat, but overall the distribution points to steadying demand and improving backlog conversion among higher-performing firms.

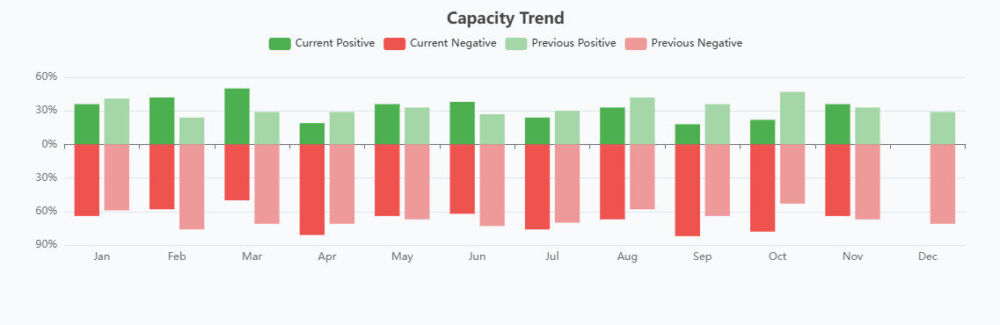

- Capacity: Still constrained, but modestly improved from last year. 64% of integrators report negative capacity—still running at or beyond their delivery limits—but this is slightly better than the same period last year. Capacity pressure continues to be driven by firms with strong project loads, while lower-performing firms have available capacity but insufficient demand.

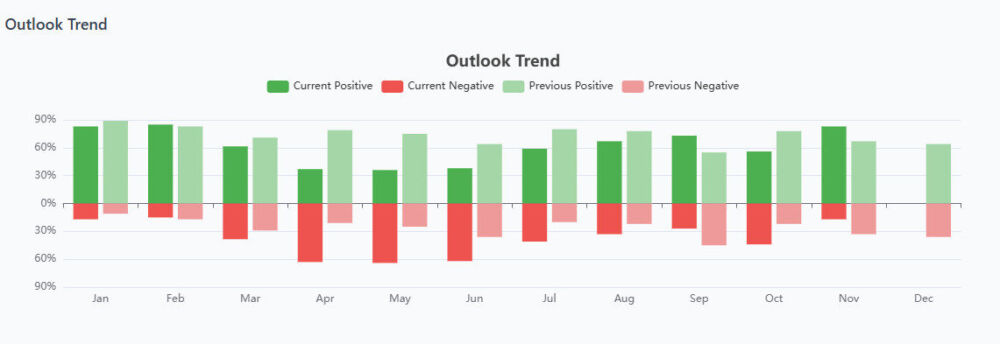

- Outlook: Confidence turns sharply upward. 83% of respondents report a positive outlook, up dramatically from last year’s 67% and reversing October’s pullback. This is one of the strongest optimism readings of the year and suggests integrators expect project activity to improve in early 2026.

November’s CSIA EZ Stats tell a different story than October’s softness: the SI community is showing early signs of recovery, with momentum beginning to build in revenue, sentiment, and capacity utilization.

- Momentum is forming at the top of the market. The surge in top-quartile revenue indicates that well-positioned, well-capitalized integrators are beginning to capture released projects. This is consistent with a broader manufacturing narrative where confidence is returning before activity fully turns.

- Optimism leads actual performance. The sharp jump in positive outlook (83%) is an important leading signal. Historically, optimism turns 1–2 quarters before revenue growth broadens. Integrators appear to be anticipating better conditions by mid-2026.

- Operational discipline still matters. Capacity remains tight for many firms, even as demand remains uneven. This reinforces the need for strong project management, staffing models, and delivery predictability to prevent capacity constraints from limiting growth when demand improves.

- Opportunity for partnership continues. Even with uneven workloads, clients continue to wrestle with labor shortages, reliability concerns, and modernization needs. Integrators that position themselves as trusted capacity and optimization partners will be well positioned as the recovery takes shape.